We don’t just talk about claims. We pay them.

Insurance is a promise – a promise to help protect your way of life when the unexpected happens.

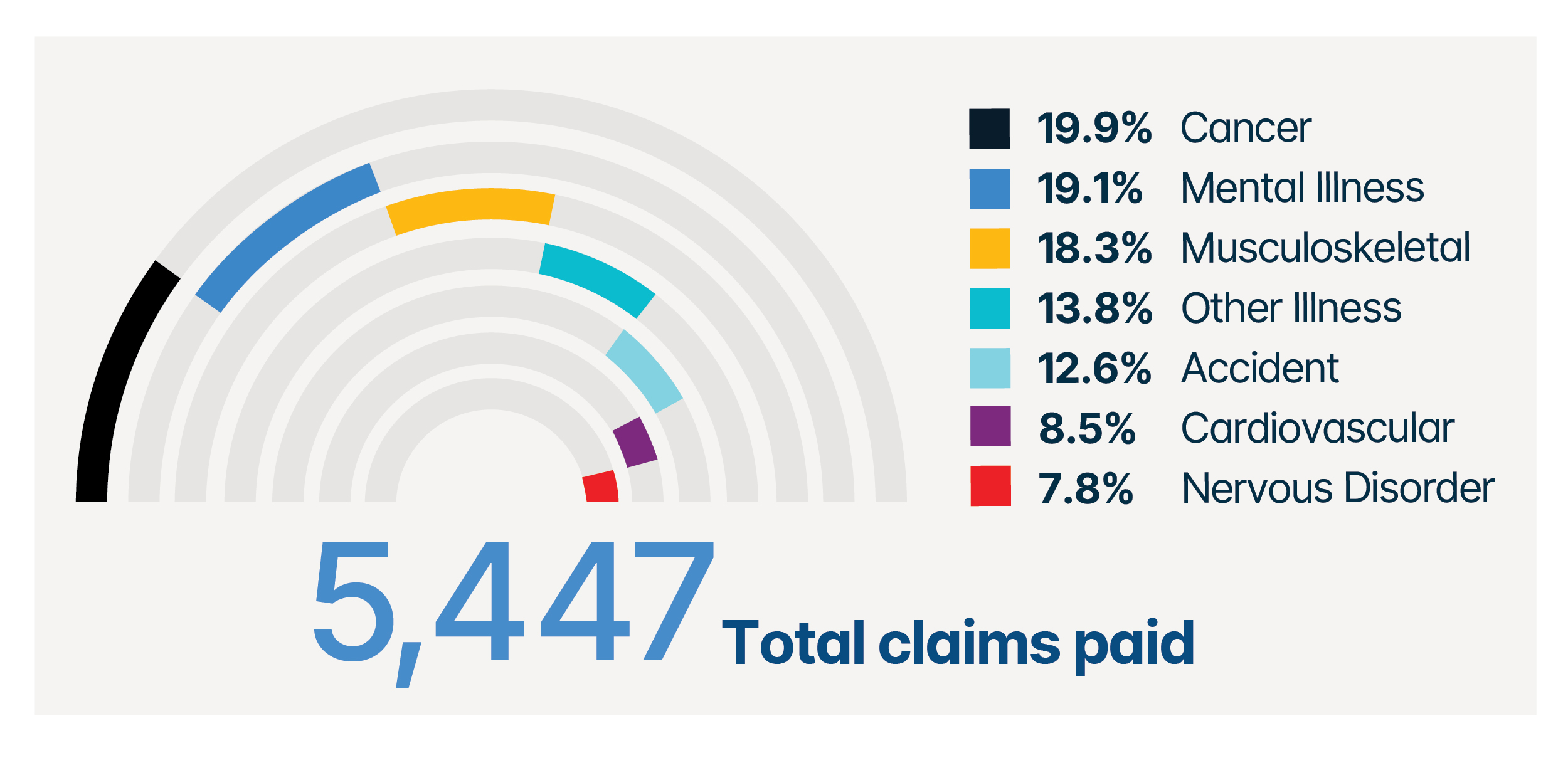

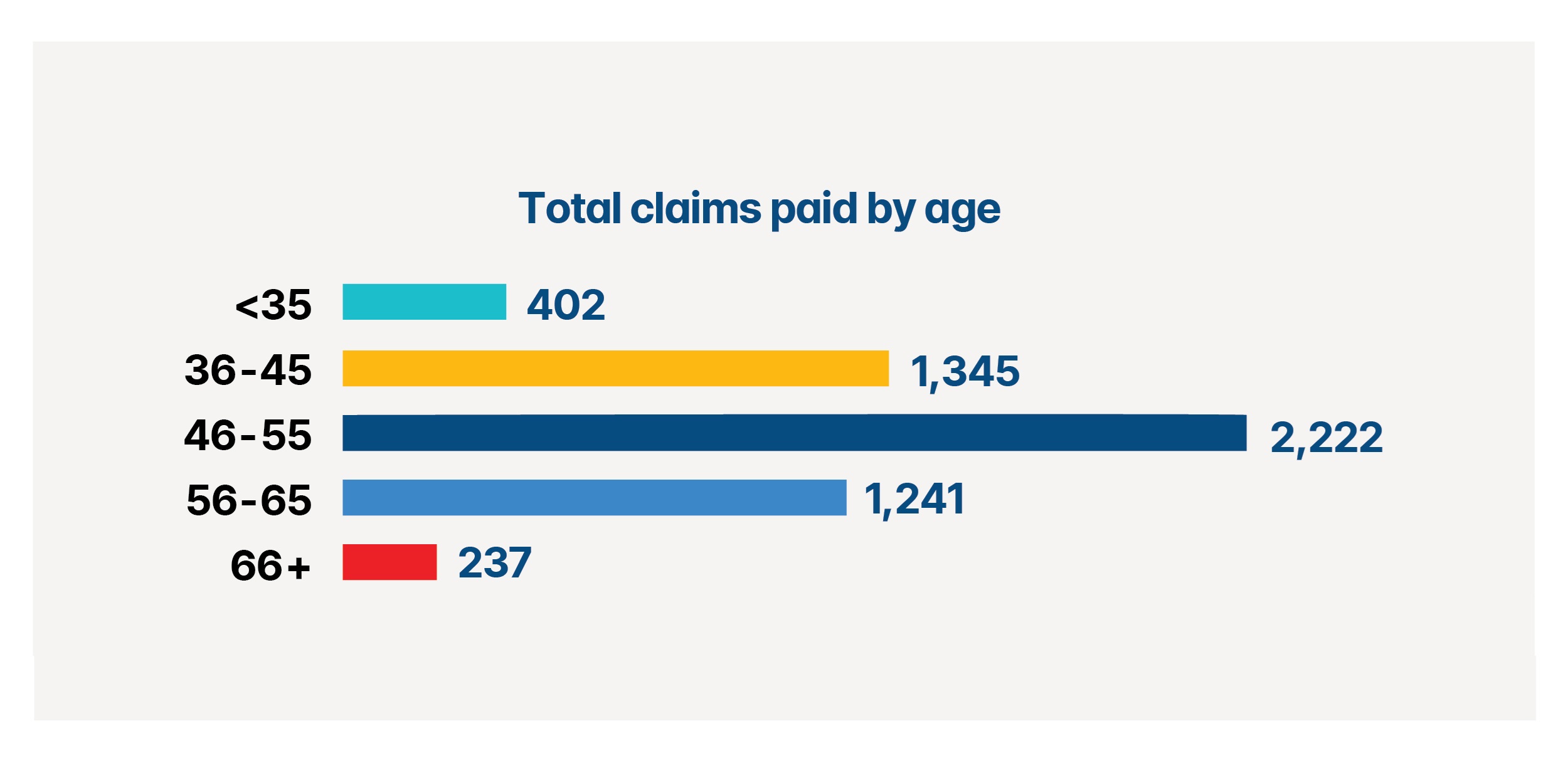

In 2024, we approved over 94% of individual claims and paid $802 million in benefits to over 5,400 customers when they needed it most. Amongst those 5,400 people we helped, our youngest claimant was just 8 years old, and our oldest was 89. This demonstrates our commitment to supporting Australians from all walks of life during challenging times.

The moment you need to make a claim can be emotional and overwhelming. That’s why we are dedicated to making the process simple, personal and supportive.

2024 in claims numbers

$802MIndividual claims paid |

5,400+Customers supported |

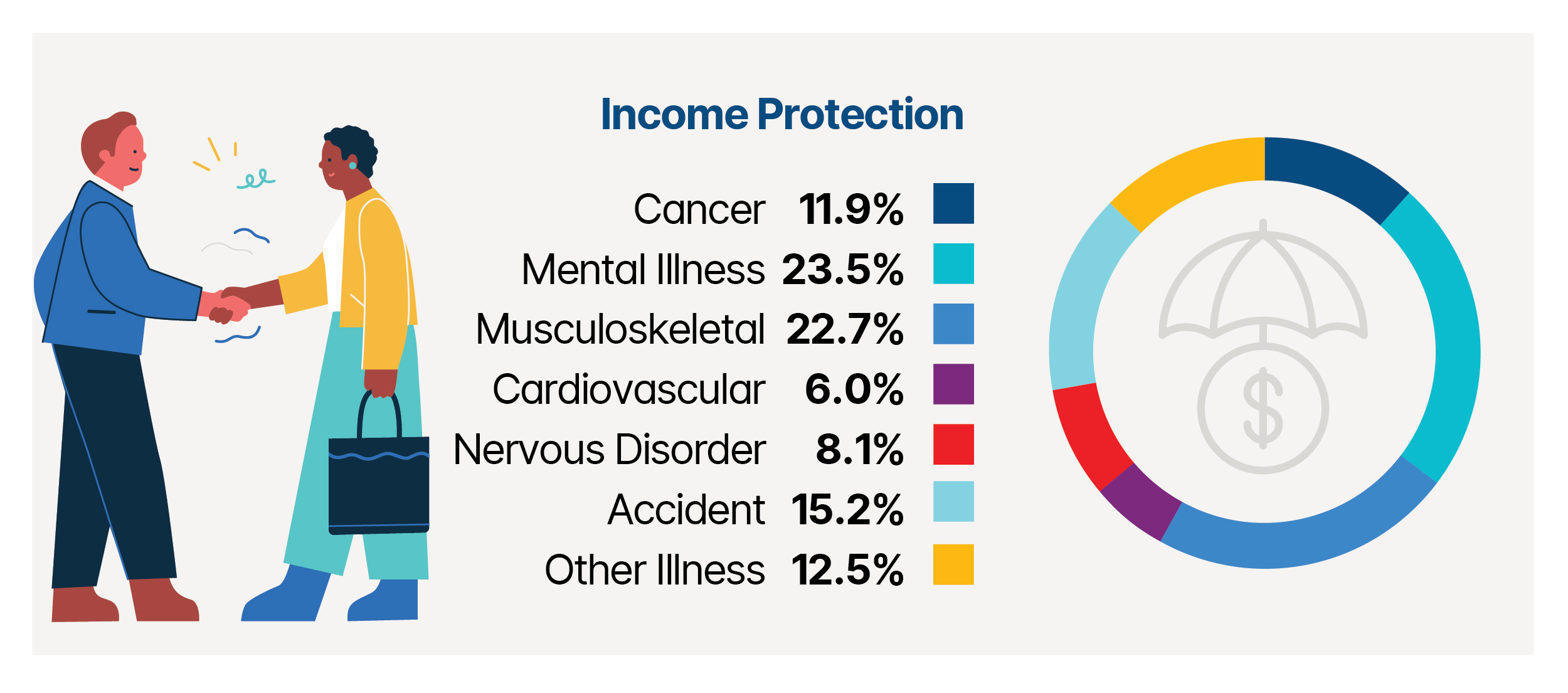

Income Protection

4,081

claims paid

Providing Australians with financial security while they recover.

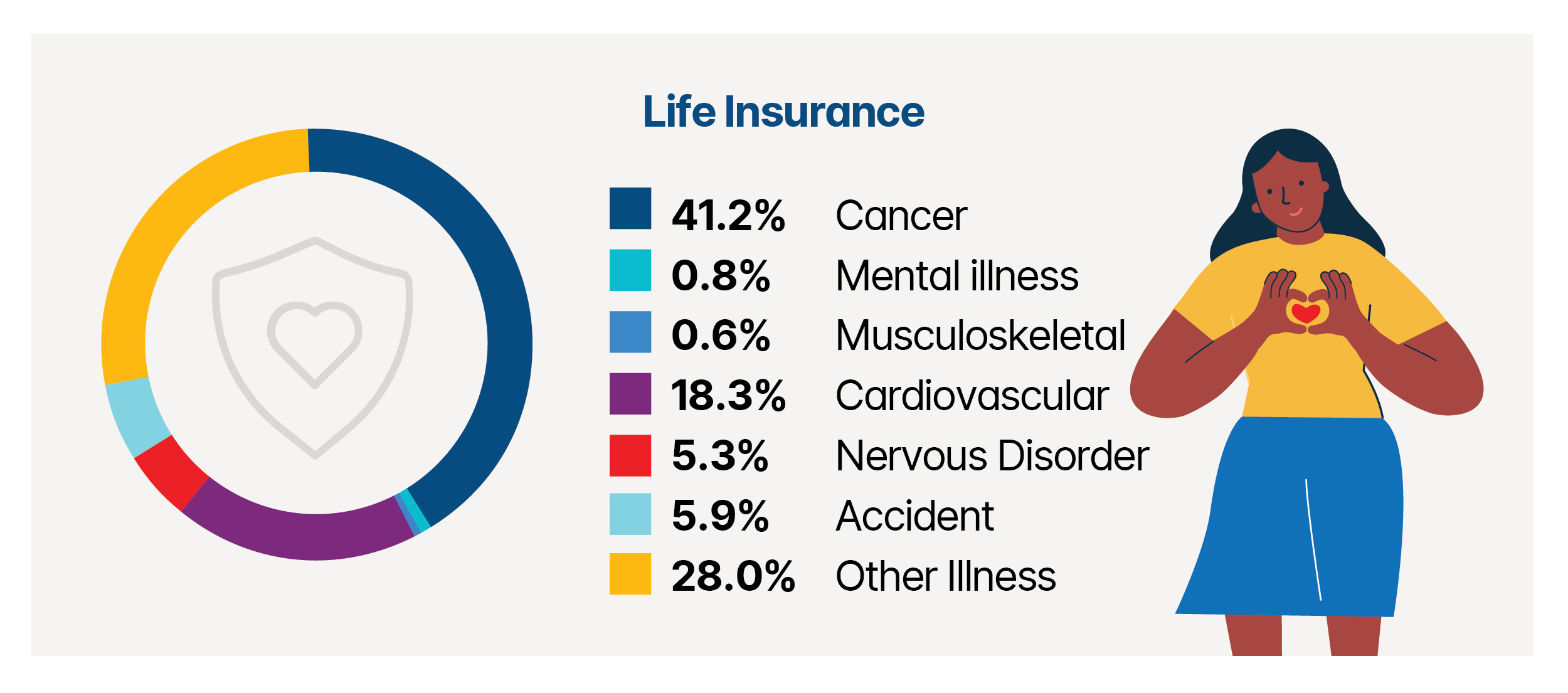

Life Cover

493

claims paid

Supporting families during their moments of loss and bereavement.

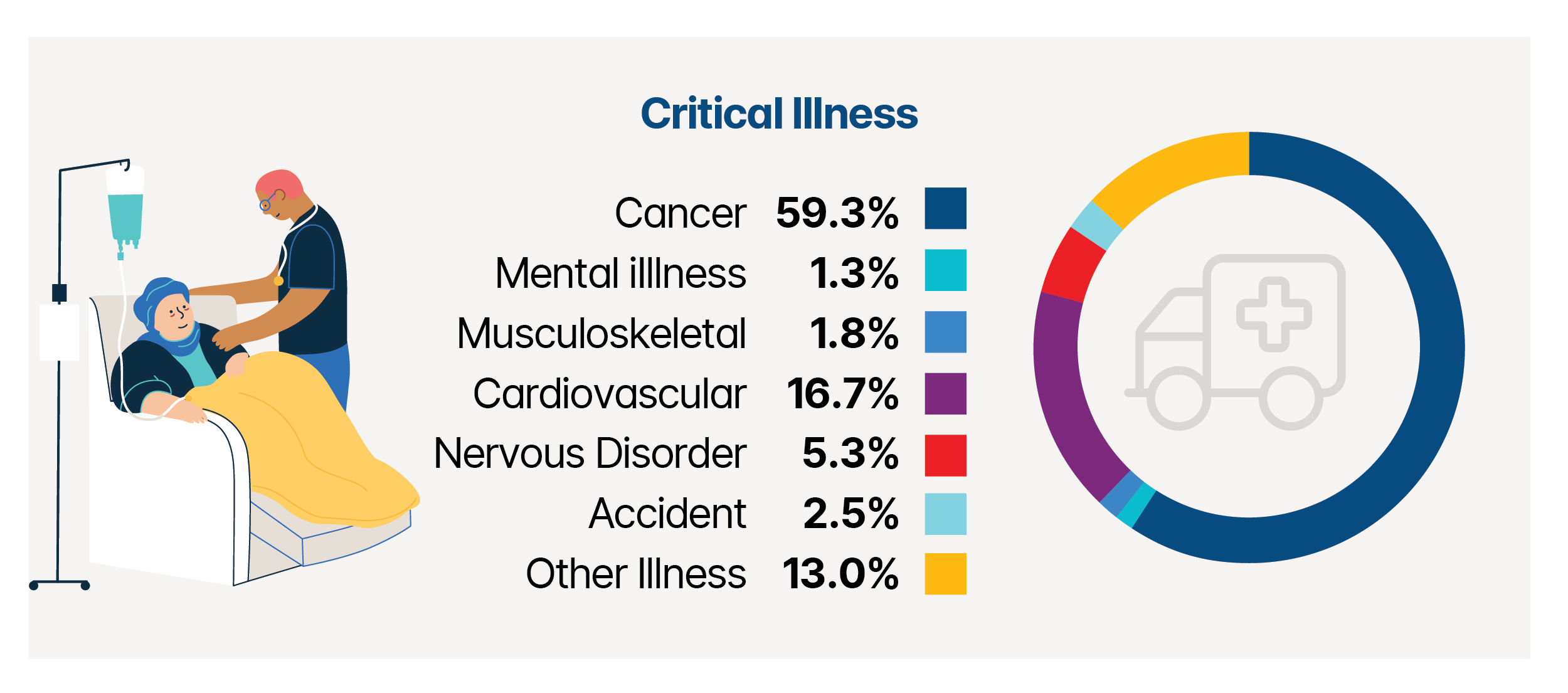

Critical Illness

609

claims paid

Helping people through critical illness.

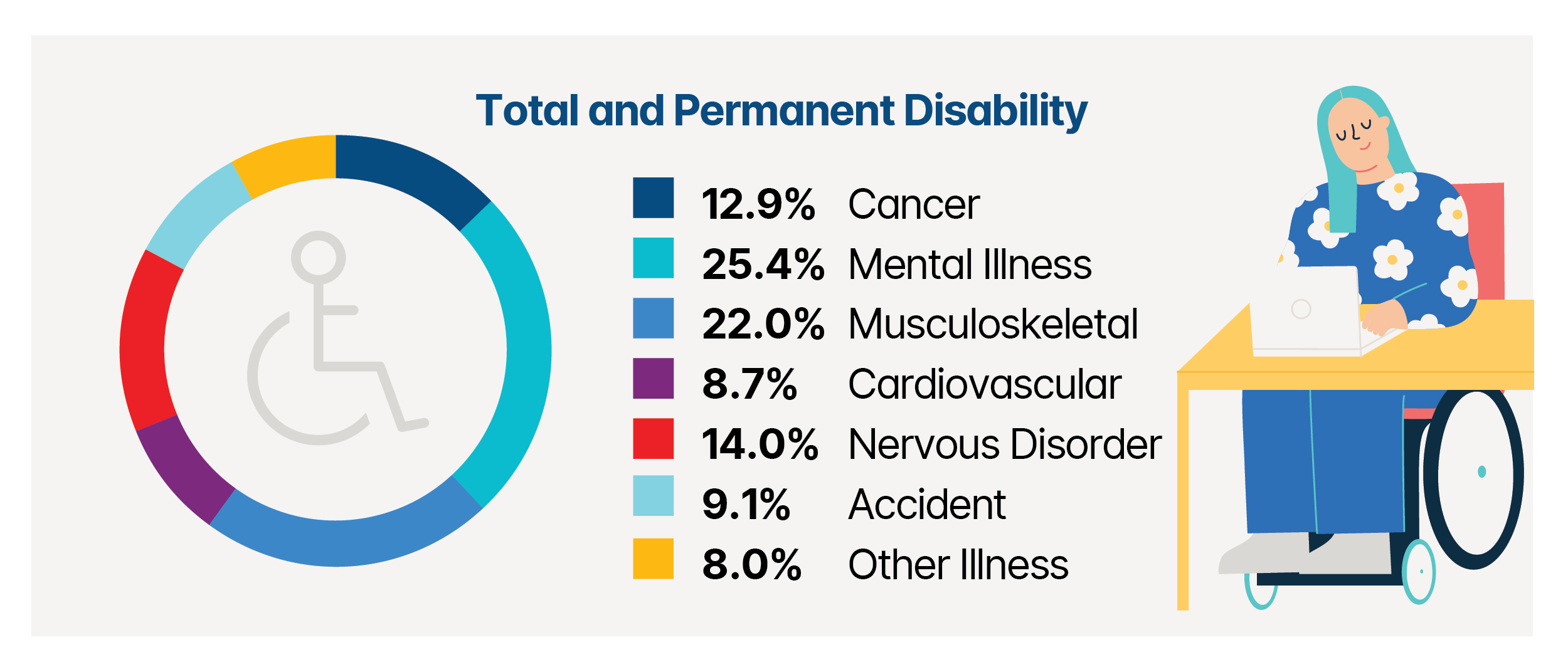

Total & Permanent Disability

264

claims paid

Providing financial support if you're permanently unable to work.

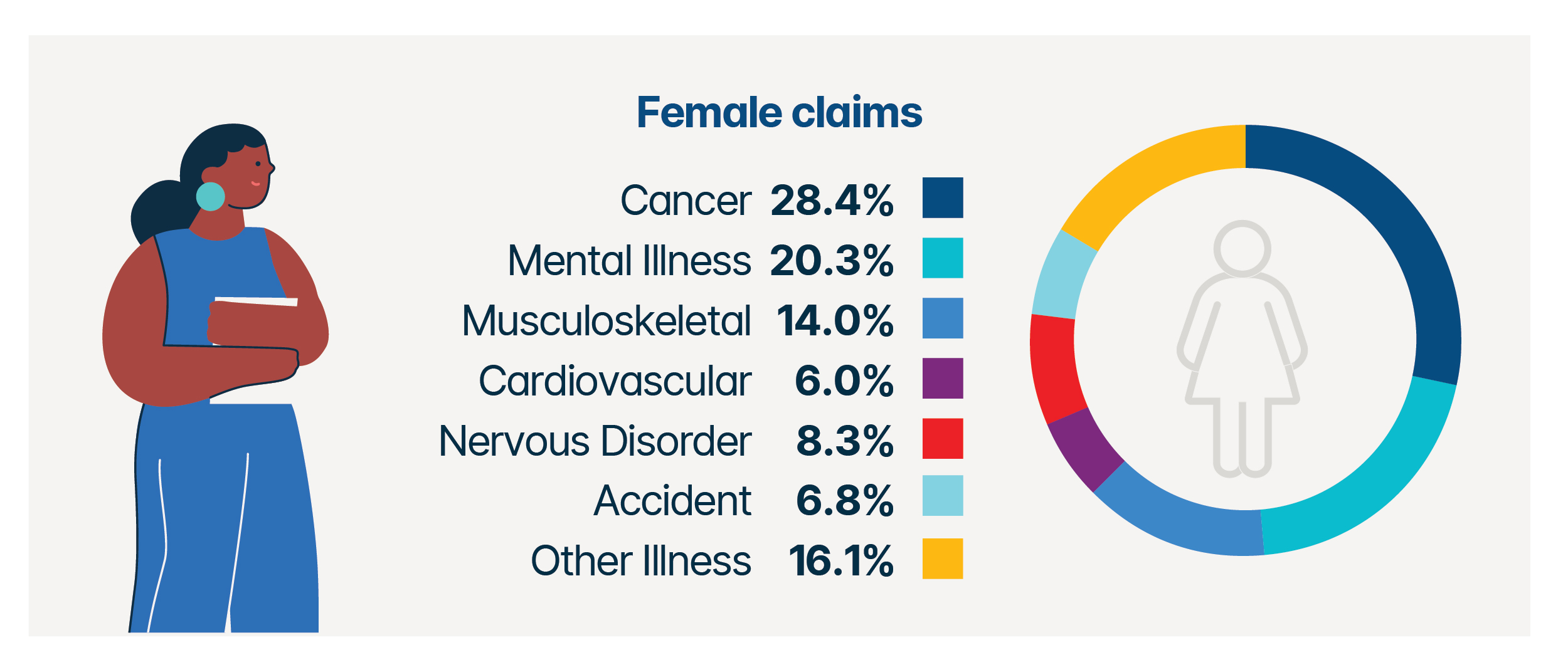

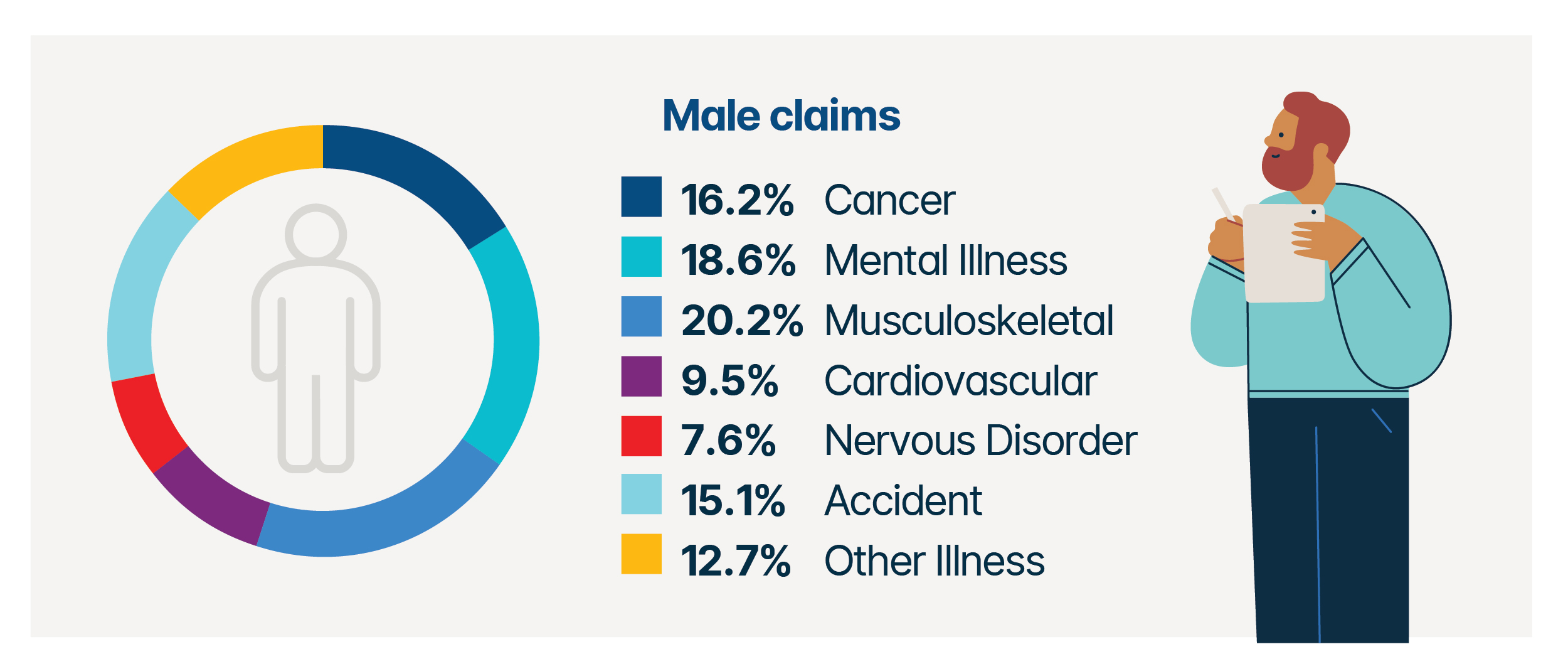

2024 claims in detail

2024 claims by gender

2024 claims by insurance product

Wellbeing comes first

We believe your wellbeing is as important as your financial security. With Vivo, you have quick access to experts for support with your health, wellness, and recovery. It’s care that’s available to you (and your immediate family for certain services) at any time and at no extra cost—not just when you make a claim.

Get started

Myth vs. reality

Myth #1

|

|

Our claim decisions were faster than industry averages - Total and Permanent Disability (TPD) claims were resolved in 6.2 months (18% faster), Life Cover decisions were made 40% faster, and Critical Illness claims were processed 27% faster than the 1.5-month industry benchmark1.

In 2025, we continue to deliver timely, accurate claim decisions when our customers need us most.

1Source: APRA Life insurance claims and disputes statistics for Claims Duration - Individual Advised.

Myth #2

|

|

- The circumstances of your claim did not meet the policy terms which entitle you to a benefit.

- Inaccurate information: The personal information provided during the application process was not accurate.

- Policy exclusions: The event or its cause wasn’t covered under the policy terms.

- Policy lapse: The policy wasn’t in-force at the time the claim event occurred.

Ensuring your cover is appropriate to your needs is key. Speaking with a financial adviser will help with this.

Real stories. How we’ve helped our customers.

Dedicated support in your time of need can make all the difference. Watch Damien’s story to hear one of our customers share their claims experience.

Why do some claims get rejected?

While the overwhelming majority of claims are approved, those that aren’t are typically declined on the following grounds: